In recent years the United States of America have lost its former influence monopoly on many Middle East processes. The vacuum arose after the loss of traditional footholds of influence was gradually filled by China and partly by Russia, which resulted a strengthening position in Saudi Arabia and the United Arab Emirates. This process began to be observed in 2017 when China resorted to oil blackmail of Saudi Arabia (temporarily reducing the amount of oil imported from the SA through a lucrative contract with Iran). The failure of the American operation to transfer energy resources from the Persian Gulf to Europe (the actual blockade of the project due to the war in Syria) led to the disappointment of the Middle Eastern monarchies in the reliability of the alliance with Washington.

Whilst until 2013 friendship with Washington was not disputed, as it promised unequivocal profits, recently the political leaders of the Middle East countries consider it necessary to focus not on political alliances, but profitable futures contracts. The US conflict with China and Russia, the collapse of the monopolar world – all this leads to a rapid rise in energy prices, and it is difficult for the US to convince its former allies that it is necessary to increase oil production, lower the price of oil (and, accordingly, gas). According to the Kuwaiti analyst Al Saadat, “The United States is forgetting that now is not the 80s of the twentieth century, and Biden is by no means Reagan.”

The excessive ideologization of foreign policy (including in the Middle East) harms the United States itself. The constant emphasis on the need to fight authoritarianism in Russia and China makes the Middle Eastern sheikhs think – most of the countries of the Middle East are authoritarian. This makes much think: will the Middle East countries become a target for pressure from the United States too soon?

This Content Is Only For Subscribers

Washington’s stance on Saudi Arabia following the assassination of opposition journalist Khashoggi has been revealing too many. The West has long used sanctions as a tool to punish rogue states; Iran is a good example. However, the comprehensive technological and financial sanctions imposed on Russia because of the war in Ukraine have heightened the fears of Middle Eastern countries that they, too, could be targeted by such sanctions.

Moreover, over the past few years, the position of the United States in the region has seriously deteriorated – and this is due not only to the conflict with Saudi Arabia.

Relations between the United States and Israel have become more complicated. This was mostly due to Biden’s efforts to restore the deal with Iran and US warnings regarding the expansion of Israeli settlements in the West Bank. At the same time, the increased influence of Russia in Syria and Iran forced Israel not to be too zealous in terms of the Kremlin’s accusations.

The United States also faced difficulties in relations with Egypt, to which the Americans provide military support, but at the same time in January, they froze $ 130 million in military aid, tying this to concerns about human rights in the country.

Also, it is necessary to note the degradation in US relations with Turkey. The White House has been critical of Turkish President Recep Tayyip Erdogan’s domestic policies, and even though many Turks accuse America of attempting a coup in 2016. As a result, Istanbul deepened cooperation with Russia through energy deals, and increased trade and tourist traffic.

The strategic withdrawal from the Middle East not only failed to help the US focus on strengthening its position in the great power competition with China and Russia but also opened up prospects for US rivals to increase their influence in the region. However, the reality is not so simple.

As a major producer of fossil fuels, the Middle East is undeniably important to the US. Moreover, it was extremely high energy prices that forced Biden to attempt to improve relations with Saudi Arabia. Up until recently, Biden shunned Crown Prince Mohammed bin Salman, the country’s de facto governor, over the prince’s alleged role in the 2018 assassination of Saudi journalist Jamal Khashoggi in Turkey.

During his visit to Saudi Arabia, the US President expressed his intention to achieve a significant increase in oil supplies to the world market to prevent further price increases, reduce the competitiveness of Russian oil, and decrease revenues from oil exports to the Russian budget. Still, following the meeting in Riyadh between Russia and the Cooperation Council for the Arab States of the Persian Gulf at the level of foreign ministers, the parties reaffirmed their commitment to the existing agreements. The Gulf states take a neutral position regarding Ukrainian events, and the upcoming transition to the yuan in settlements with China for oil supplies indicates a change in their development vector. In addition, they are frankly tired of the volatile and extremely opportunistic US policies and are unlikely to forget that during his election campaign, Joe Biden promised to turn Saudi Arabia into a “rogue state.”

It is possible that export quotas under the OPEC+ agreements, that is, including the Russian Federation, will be subject to changes, but this will be caused by pragmatic considerations, not political ones. Extremely increased oil prices are unprofitable for traditional oil exporters because after overcoming a certain price range (now it is at the level of about $150 per barrel at current quotations of about $120), there will be an explosive growth in oil production by fracking (hydraulic fracturing), which, in turn, is fraught with a collapse of the market. As part of the OPEC+ agreement, regular consultations will inevitably continue to keep quotes within a reasonable range. The geopolitical situation, as always, will continue to have a significant impact on the oil market, but the Gulf states and Russia intend to continue cooperation based on common interests and not instructions from the West.

In early May 2022, OPEC ministers declared following the previously approved plan. The Secretary General of OPEC noted in his speech that “free capacity simply does not exist.” Most OPEC+ members are operating at maximum capacity. Saudi Arabia and the United Arab Emirates, which have spare capacity, say that the increase in oil production will lead to higher prices, not lower them.

According to IMF calculations, the Middle Eastern and Northern African oil exporters will receive an additional $320 billion this year. Forecasts show that the economies of Arab oil producers in 2022 will grow more than in any other economic region in the world. At the same time, the funds are planned to be spent on the internal fight against inflation and on social programs (for example, Algeria increased pensions by 10% in March and introduced new unemployment benefits).

That is why, as a result of Biden’s visit to Riyadh, more than dubious success was achieved – Prince Mohammed said that Saudi Arabia could increase oil production in the future by no more than 3 million barrels per day (up to 13 billion instead of the current 10 billion, which will not significantly affect on prices). The absence of assurances from Saudi Arabia regarding the increase in oil production led to a rather sharp jump in oil prices (+5.1%) immediately after Joe Biden visited Riyadh.

On July 16, during a press conference in Jeddah, US President Joe Biden stated that his country did not intend to leave the Middle East, “leaving a vacuum that would be filled by Russia, China or Iran.” “Let me be clear that the United States intends to remain an active and engaged partner in the Middle East,” Biden said. As the world becomes more competitive and the challenges more complex, Biden said, it becomes clear “how closely America’s interests are intertwined with success in the Middle East.”

On the same day, an unnamed senior official of the White House spoke that Middle Eastern countries no longer want to strengthen ties with Russia and China. “We have heard from every capital in this region that their first choice, their priority is the United States. And we are committed to following this path and finding areas of cooperation,” he said. According to the official, half a year ago, in many capitals of the countries of the Middle East, “a turn towards Russia and even China in many directions” was visible, but now this has been suspended in “very specific cases.” The official also expressed the opinion that the countries of the Middle East will continue relations with the Russian Federation and China, since they are quite natural, but in specific areas, preference will be given to Washington.

However, already on July 17, the Crown Prince of Saudi Arabia, Mohammed bin Salman, said that if the United States continues to adhere to the course of imposing its values on other countries, they risk losing all allies except members of the NATO bloc. He recalled that attempts to impose values on other countries, in particular, Iraq and Afghanistan, were not successful.

The main tool for influencing the situation in the energy market, which the United States sees, is the establishment of a ceiling on oil prices, which will deprive Russia of excess profits. The same position is supported by the leaders of the European Union. For example, in June, the leaders of the G7 countries, following a three-day meeting in Germany, decided to start technical work on an initiative that would impose a “price ceiling” on Russian oil and gas. The G7 leaders also agreed to explore the possibility of introducing a complete ban on services for the transportation of crude oil and petroleum products from the Russian Federation until they are sold at a price agreed upon by the international community. According to Bloomberg, marginal prices can be set at $40-60 per barrel (oil from the Russian Federation is traded at $80-85 on average).

However, this idea is not supported by the OPEC+ countries, which insist on a market mechanism for setting oil prices – without the use of voluntaristic measures. “Let’s keep economics and politics separate,” officials in Riyadh said. This is genuine while the price per barrel of oil is trading at $102-105.

Elimination of energy dependence on Russia

On March 5, 2022, US President Joe Biden and European Commission President Ursula von der Leyen announced the formation of a joint working group aimed at ridding Europe of dependence on Russian oil and gas. It was officially announced that a group led by representatives of the White House and the European Commission will seek to find alternative sources of liquefied natural gas and reduce the overall demand for natural gas.

In particular, the group focuses on increasing importing Middle Eastern oil to Europe due to European sanctions on goods from Russia, with supplies from countries such as Saudi Arabia and Iraq.

“Now we see the redirection of these barrels from Asia to Europe. This is because Europe is reducing the purchase of Russian barrels, and at the same time Russia is sending its oil to Asia, the key market in the Middle East, ”Giovanni Staunovo, an analyst with UBS Group AG, stated to Bloomberg.

Saudi Arabia supplies tankers with oil to Egypt, where it enters the Sumed pipeline. It connects the Ain Sokhna terminal on the Red Sea coast with the Mediterranean port of Sidi Kerir. There, oil is shipped on tankers to Europe. According to the agency, in the first three weeks of July, oil supplies via the Sumed pipeline from the Middle East to Europe amounted to more than one mln barrels per day (200,000 barrels more than in June), and about 1.2 mln barrels per day via Suez. Thus, during this period, the total import of oil to Europe from the region reached about 2.2 million barrels per day. This is 90% more than in January, the last month before the start of Russia’s aggression in Ukraine. The 6th package of EU sanctions against Moscow provides for, among other things, the gradual introduction of an embargo on oil imports from Russia. The ban will only affect supplies by sea, and the oil coming through the Druzhba pipeline is not subject to restrictions. Also, the EU has high hopes for Caspian oil offered by Azerbaijani President Ilham Aliyev. However, Azerbaijan’s European partners lack confidence in the actual amount of oil Azerbaijan controls and can supply to European markets.

But in general, the only way left for the EU is to rely on support from the US. In the context of the internal political and economic crisis that the states of the European Union faced in 2022, it is obvious that Brussels is not capable of developing an effective, autonomous energy policy of its own and is forced to cooperate with the United States closer.

Russia strengthens contacts with the Middle East

At least four people in Russia are responsible for rapprochement with Riyadh and other Middle Eastern states: the head of the board of Rosneft and Vladimir Putin’s closest friend Igor Sechin, Deputy Prime Minister of the Russian Federation Alexander Novak, who is deemed a personal friend of Prince Mohammed, the head of Chechnya Ramzan Kadyrov, also closely associated with the royal family of Saudi Arabia, as well as billionaire Mikhail Gutseriev, who in Russia is considered the main liaison with influential Middle Eastern houses.

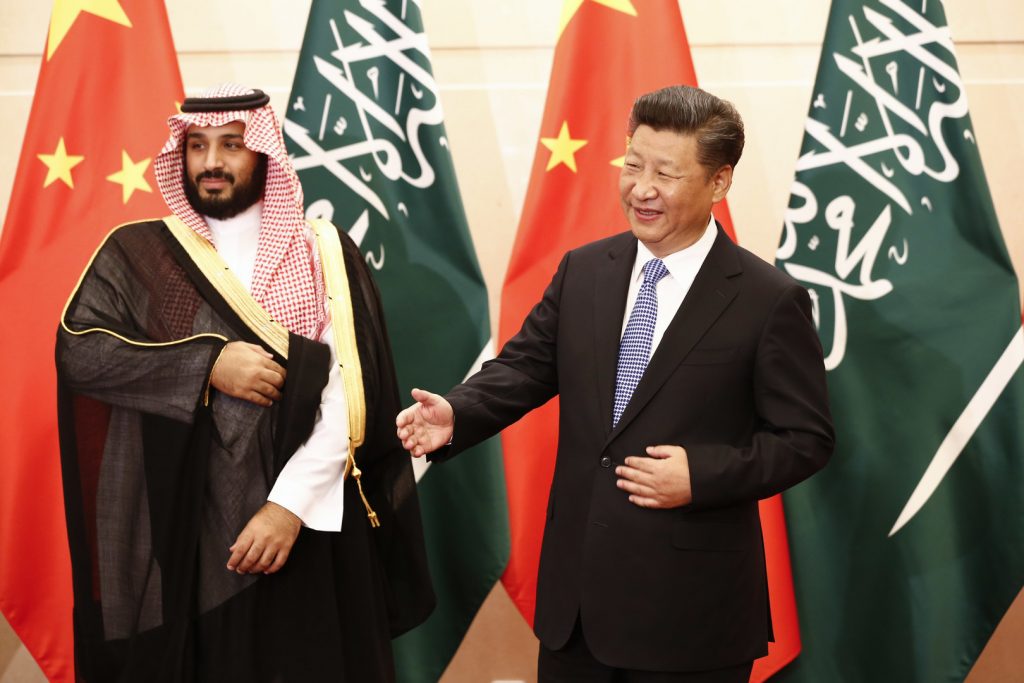

Since 2018, the Crown Prince of Saudi Arabia Mohammed bin Salman has begun a serious reorientation of the kingdom’s foreign policy toward cooperation with Russia and China. During that summer, Mohammed visited the St. Petersburg International Economic Forum, where he met President Vladimir Putin in person, and later in October, King Salman of Saudi Arabia paid an official visit to Moscow. From this moment on, we can talk about a serious change in the orientation of Riyadh (until 2018, it was considered one of the most reliable US partners in the region).

In June 2022, Crown Prince Mohammed’s brother, Abdulaziz bin Salman al Saud, took part in the St. Petersburg International Economic Forum – even though the United States called on all states to boycott the event. The official website of the Russian government reported: “At the SPIEF (St. Petersburg International Economic Forum), Deputy Prime Minister and OPEC+ Co-Chairman Alexander Novak discussed measures to stabilize the global oil market with the Minister of Energy of the Kingdom of Saudi Arabia, Abdulaziz bin Salman Al Saud.

After meeting with the Deputy Prime Minister of Russia, the Minister of Energy of Saudi Arabia was laconic and smiled enigmatically. “Good,” Abdulaziz bin Salman Al Saud replied to a question about the relations between Russia and Saudi Arabia. “The weather is the same as the weather in Riyadh,” the minister commented on relations between Russia and Saudi Arabia. Russian Deputy Prime Minister Alexander Novak, in turn, said that the extension of the OPEC+ deal after 2022 would depend on the situation in the market by the end of the year. “We have a long-term charter, but everything will depend on the situation that will develop on the market, whether it will require some kind of quota, or there will be simply interaction within the framework of the charter. By the end of the year, it will be better to see.”

On May 22, the Financial Times reported that Saudi Arabia wants to work out an agreement with OPEC+ in which Russia will participate, thereby emphasizing the role of the Russian Federation in the organization. Saudi Energy Minister Prince Abdulaziz bin Salman Al Saud told the publication that the Saudis hope to “work out an agreement with OPEC+ … which includes Russia.” So he focused on the fact that “the world must respect the value” of the unification of oil-producing countries. The Minister also added that it is too early to discuss the specific provisions of the new agreement due to the uncertainty in the market.

Russia began to reorient oil supplies to Asian markets in March-April of this year due to the refusal of Western countries to buy Russian raw materials because of the war in Ukraine. The United States and Great Britain announced a complete embargo on Russian oil in early March, and the EU was able to agree on a partial ban on offshore oil supplies from Russia as part of the sixth package of anti-Russian sanctions only on May 31. At the same time, restrictions on supplies via the Druzhba pipeline with a capacity of 720,000 barrels per day will not be introduced soon.

According to the International Energy Agency, in May, Russia’s monthly revenues from hydrocarbon exports increased by $1.7 billion and totalled about $20 bln.

“The unprecedented rise in crude oil prices is unabated and today it is trading at higher levels than before the start of Russian aggression against Ukraine,” the agency said in a report issued on June 15th. Compared with the twentieth of February, by mid-June, the benchmark North Sea Brent rose by 31% to $121 per barrel, and American WTI rose by 22% to $118 per barrel. As a result of the embargo, Russian oil became profitable for consumers, as it was traded at a discount to Brent (up to $30/bbl Urals; a lighter oil of the same name from Siberian fields is exported through the Eastern Siberia–Pacific Ocean oil pipeline). But having the higher cost of reference varieties, even with a discount, export remains profitable for both Russian mining companies and the state budget.

By getting oil cheaper than the collective West, China, India and other Asian countries increase their global competitiveness, which directly affects the interests of the United States and its allies, and destroys their concept of total isolation of Russia. A gradual but active transition to national currencies weakens the position of the dollar as a monopoly international means of payment. The West overestimated the degree of its dominance in the modern world: the sanctions it imposed were not supported by other states with powerful economies and political will to strengthen their sovereignty and their competitiveness, including through cheaper energy resources than in the West.

European Commission President Ursula von der Leyen said that a “complete and immediate” withdrawal from Russian oil would only strengthen Russia.

For the United States, there is no question of eliminating Russia from the market, and in the current circumstances, there are no reliable levers that would allow the United States to play such a game. But we are talking about a significant limitation of the “ceiling” of the cost of oil produced in the world – to lead to a decrease in the level of Russia’s income. Earlier, US Treasury Secretary Janet Yellen said that Washington is interested in continuing to supply Russian oil to world markets, but at forcedly reduced prices. According to her, this initiative is being actively developed by the United States and its allies, which are facing record inflation after a complete or partial refusal to import energy from Russia.

A similar position was communicated by US President Joe Biden before he visited Saudi Arabia. He said that Washington is discussing with European allies a mechanism to contain rising oil prices by continuing to purchase from Russia, but at “limited prices.” These statements speak of the recognition by the West of the insufficient effectiveness of the oil embargo and the search for ways to continue economic pressure on Russia while minimizing damage to its economy and maintaining competitiveness with growing Asia.

On June 30, Deputy Prime Minister of Russia Alexander Novak, being live on the Russia-24 TV channel, said: “The intention to restrict the price of Russian oil is an attempt to interfere in the market, which can lead to an imbalance and an increase in prices.” “In my opinion, this is another attempt to interfere in market mechanisms, which can only lead to market imbalance, a shortage of energy resources, which, in turn, will lead to an increase in prices and, accordingly, to consumers, primarily European and G7 countries, at a more expensive price of energy resources on the world market,” Novak said. He called the planned measures of Western countries directed against themselves, citing the already existing restrictions on energy resources from the Russian Federation as an example.

“The decisions that were taken by the EU on the embargo on Russian coal only led to the fact that coal prices rose, and we see a deficit. The work of coal stations is being restored, and at the same time, we see a shortage of coal in Europe. These, of course, are ill-conceived and economically unjustified measures, and they will only lead to an increase in the burden on European consumers,” the Deputy Prime Minister of the Russian government added.

On July 20, Novak said that Russia would not supply oil to world markets if, if the G7 countries introduced a price ceiling, its final cost would be lower than production costs. “This means that we simply will not work at a loss.”

Riyadh is having to balance as it seeks to improve strained relations with the US while strengthening the oil alliance with Russia that it has worked to build for decades.

Under such conditions, as predicted, the United States could not count on quick success in negotiations with Riyadh. The US is paying the price for political mistakes.

Saudi Arabia is not only a producer of its own but also a buyer of Russian fuel oil. In Riyadh, they decided to capitalize on the difference in prices between Russian oil, which the Saudis buy at a big discount, and Arabian oil, which they sell to the whole world, of course, without a discount, at market prices.

Exports of fuel oil from Russia to Saudi Arabia in the second quarter of 2022 doubled compared to the second quarter of the previous year. In April-June, Riyadh bought 647,000 tons of fuel oil from Russia. In April-June 2021, imports were much more modest – 320 thousand tons. The Saudis are buying cheap oil from Russia to send more of their oil for export.

Saudi Arabia is one of the few countries that generate electricity from oil. In recent years, however, it has taken steps to reduce the number of oil-fired power plants and, accordingly, increase the number of gas-fired power plants, as well as increase gas production to sell as much oil abroad as possible. Now, in the summer, during the peak season of energy loads, Riyadh is very actively buying oil and oil products from Russia at a discount.

Naturally, even Saudi Arabia’s increased dependence on Russian oil and fuel makes it difficult for US diplomats and politicians to convince Riyadh to join the price ceiling for “black gold” from Russia. This is now the White House’s fixed idea, which is advocated by President Biden, Treasury Secretary Yellen, as well as several other high-ranking US officials.

Joe Biden’s visit to Riyadh clearly showed everyone, and especially Washington, that relations between Saudi Arabia and the United States are likely to never be the same as they were 5-10 years ago. On the contrary, relations between Riyadh and Moscow are developing on the rise. Moreover, both at the bilateral level and within the framework of the OPEC + agreement, which has proven its effectiveness. Judging by the results of Biden’s visit, the Saudis do not intend to refuse cooperation with Russia in determining the price of oil. They are well aware that their accession to the Russian oil price ceiling could undermine this cooperation. At the same time, they do not intend to refuse cooperation with the United States – but in a limited way, without a “strategic imbalance” that could lead to a crisis and a drop in oil profits.

Strengthening the struggle of major players for influence in the Middle East

Today it can be predicted that intensifying the struggle of major players for influence in the Middle East is possible. At the same time, Riyadh understands that over the next few years, it is the Middle Eastern monarchies that will play the “golden share” in the global energy confrontation. Prince Mohammed is just bursting with bold projects within the country (for example, the project of the new city of Neom).

The prince managed to get several concessions from Biden (for example, the withdrawal of American troops from the islands in the Red Sea, which were transferred by the Egyptian authorities to Saudi Arabia two years ago), but these are not the concessions that Mohammed is counting on. The United States essentially has nothing to offer Saudi Arabia in exchange for a request to cap oil prices and increase oil production. For the first time, Washington has nothing to interest Riyadh, which felt a quick and easy profit.

Biden’s visit underscored how powerful Saudi Arabia’s leverage is. The kingdom will likely use this leverage to convince the United States to continue its military involvement in the affairs of the Middle East. These arguments will be reinforced by warnings (and likely to be echoed by Israel) that China and Russia will quickly fill any security vacuum the US leaves behind.

Under such conditions, experts began to predict the possibility of producing new conflicts in the Middle East, “colour revolutions” and conspiracies that could temporarily stop the negative trends for Washington and Brussels. “Prince Mohammed should seriously fear for his safety,” many publications wrote immediately after Biden visited Riyadh.

The US may try to play on the contradictions between the major players in the Middle East – Egypt, Iran, Iraq, Israel, Saudi Arabia, and the United Arab Emirates – are opponents among themselves. For example, Iran and Saudi Arabia are willing to do business with the same states, but each of these countries will not maintain good relations with a state that develops serious security relations with its main rival. However, in contrast to Washington, Russia and China, on the contrary, are trying to reconcile the Middle Eastern players, convincing them that joining forces can play into the hands of everyone. In this regard, the visit of Vladimir Putin to Iran, as well as the mission of Sergey Lavrov in the Middle East region in December 2021 and May-June 2022, looks very important.

Geopolitically, Saudi Arabia is signalling to the United States that it is more interested in engaging with China and Russia.

The fact that China is not in a rush with advancing security interests in the Middle East indicates that it understands the story as well. Even in the case of Iran, which could play the role of a proxy player in the strategic rivalry between China and the US, China has avoided moves that could jeopardize its relationship with Saudi Arabia and other Gulf countries. For example, unlike Russia, it refrains from supplying advanced weapons to Iran.

Against this background, China is likely to continue to rely on diplomatic and economic tools to expand its influence in the Middle East. It seems clear that the only way for the US to counter these efforts is by raising the stakes in this diplomatic and economic game.

Economic relations remain the most effective tool for China and Russia to expand their geopolitical influence. In 2020, commodities trade between China and the Middle East summed to USD 272 bln. While there are no comparable statistics on US trade with the Middle East, much is clarified by the two powers’ trade with Saudi Arabia. During 2000 and 2021, America’s trade with Saudi Arabia grew only modestly, from USD 20.5 bln to USD 24.8 bln, while China’s trade increased dramatically, from USD 3 bln to USD 67 bln.

As China builds up its technological and innovation capacity, it may show itself as a more reliable technology supplier and a safer investment destination. Any Middle Eastern country has imposed a ban on Chinese telecom giant Huawei’s 5G networks, despite heavy US lobbying.

The US and EU decision to restrict the import of Russian energy products has already led to a significant rise in prices in the market. By supplying oil to Asian countries, primarily China and India, even taking into account significant (up to 30%) discounts from world quotations, Russian exporters still earn more than a year ago, thanks to rising prices.

Saudi Arabia, another major supplier of hydrocarbons to China, in May, on the contrary, reduced oil exports to China by 15% compared to April to 1.84 mln barrels per day.

It is possible to foresee a further strengthening of China’s position in the region, unless significant political upheavals do not occur in Saudi Arabia and neighbouring countries. Many processes will be synchronized with existing projects in the region initiated by China earlier (expansion of the Belt and Road Initiative, the China – Africa transport corridor, etc.). Taking into account the activity of China in the Central Asian energy sector, it can be considered that China will significantly increase its influence on the oil and gas sector on a global scale soon.

Most likely, in the near future, we will witness an intensification of US and EU Middle East policy, possibly resulting in establishment of an office of the US Special Commissioner for Oil and Trade in the Middle East and a similar office of a European representative. It is also possible to predict the US-European rapprochement against the background of a joint vision of problems, as well as attempts by Russia and China to prevent this rapprochement.

There are also possible attempts to blackmail and pressure the Middle Eastern monarchies to develop a common policy (although in the current conditions for the United States this will be an extremely difficult task). The US and the European Union will in many ways have to rediscover the Middle East.

However, Bloomberg predicts that in the coming years there may be a “solitaire redistribution” of energy flows, in which the Middle East with its resources will work for the European Union market, and Russia and Iran – for the markets of China and India. Perhaps the current US game is aimed primarily at achieving this result.